Developments in financial markets and their impact on KPST

Pristina, April 11, 2025: Global financial markets have recently experienced a wave of volatility due to trade tensions arising from increased tariffs in international commerce. These developments have triggered reactions in global stock markets, as tariffs could lead to a significant rise in inflation and potentially cause a global economic recession.

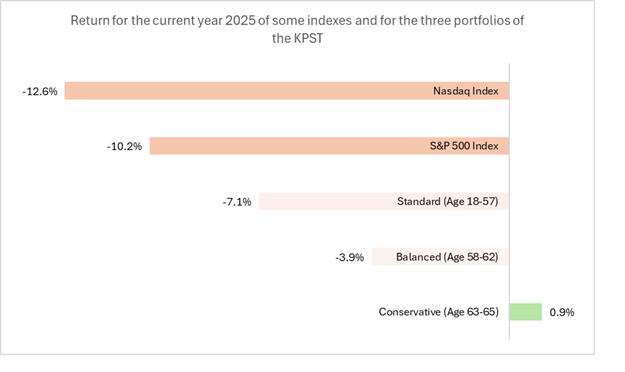

Since the beginning of 2025 until this reporting date, key stock indices such as the S&P 500 and NASDAQ have recorded declines of -10.2% and -15%, respectively. Despite this, the impact on the KPST portfolios has been more controlled, due to its balanced structure and continuously applied diversification strategy.

Below is a breakdown of the market fluctuation impact on KPST’s investment portfolios, as of April 10:

- Conservative Portfolio (for contributors near retirement, aged 63+):

This portfolio is not exposed to foreign equity markets and is therefore unaffected, offering maximum protection for contributors close to retirement. The return for the current year is +0.9%, while since the portfolio’s inception it stands at +11.3%. This confirms that all contributors who are within two years or less of retirement age are not affected by these financial market fluctuations.

- Balanced Portfolio (for contributors aged 58–62):

This portfolio has shown strong resilience against overall market declines, reflecting the protection provided by a balanced investment approach for this age group. The return for the current year is -3.9%.

- Standard Portfolio (for contributors aged up to 57):

This portfolio has been more noticeably affected by declines in equity markets but remains within expectations (when compared to broader market movements) for a portfolio with a long-term investment horizon. Equity diversification across regions and various investment factors is expected to provide substantial resilience against the “tariff war,” which may last longer than initially expected by market participants. The return for the current year is -7.1%, while since inception it stands at +69.0%.

It is important to emphasize that the current declines are considered unrealized losses, meaning they are subject to market evolution and do not constitute actual losses for contributors. KPST strategy of long-term and diversified investments remains unchanged: to ensure sustainable growth and stability for all contributors, and maximum protection for those nearing retirement.

For more information about our investment approach, please refer to KPST Statement of Investment Principles.

Comparison chart: